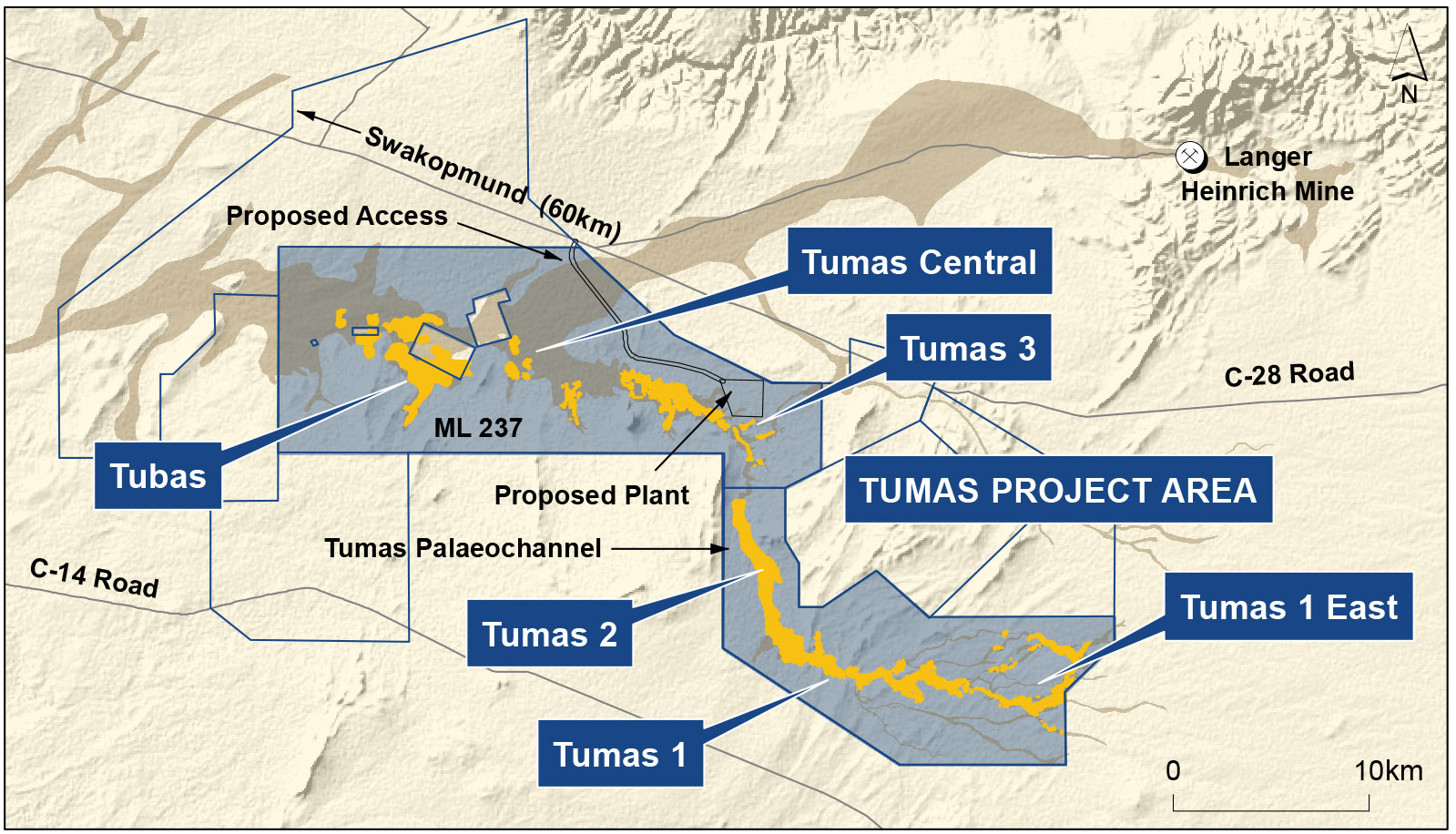

Tumas comprises of a series of palaeochannel/calcrete-type uranium deposits totalling 132.9 Mlb U308.

Uranium mineralisation in palaeochannel/calcrete-type deposits occurs as carnotite (uranium-vanadium mineral), hosted by Tertiary and Quaternary fluvial sediments occupying narrow and steep-sided palaeochannels. Host rocks vary from hard, carbonate-cemented sandstones and conglomerates (calcrete) to poorly consolidated and friable sands.

Exploration since 2016 has been extremely successful, highlighted by a more than fourfold increase in the Project’s palaeochannel/calcrete resource (mainly at the Tumas 3 and Tumas 1 East discoveries), at an extremely low discovery cost.

Tumas has a Resource of 121 Mlb (260 ppm U308), a Reserve of 67 Mlb (345 ppm U308) and Inferred Resources of 16.5 Mlb available to further expand the Ore Reserve base, with potential to add a further 10+ years to the current 22.25-year Life-of-Mine.

The Project has 125 km of highly prospective palaeochannels. Importantly, 40% of the 125 km Tumas palaeochannel system remains to be tested, providing the Company with significant exploration upside.

Tumas DFS Re-Costing Study

The Tumas Definitive Feasibility Study (DFS) completed in February 2023 was undertaken during a period of significant inflationary and supply logistical volatility.

The DFS acknowledged the previous year’s (2022) construction and operating price volatility due to global uncertainties, including the impact of the COVID-19 pandemic. The results from the 2023 DFS were presented with the full impact of the inflationary and supply chain pressures prevailing at that time.

Given the unique factors and environment in which the 2023 DFS faced and ahead of key development activities at Tumas, Deep Yellow, along with Ausenco Services Pty Ltd (Ausenco) (DFS Engineers), considered it prudent to re-cost the Project as global market conditions settled.

Deep Yellow and Ausenco performed a comprehensive market re-evaluation of the CAPEX and OPEX one year after the initial DFS pricing study.

Importantly, the results from this Re-Costing Study, which were announced in December 2023, reaffirmed the commercial viability of the Project as a long-term, high-margin, globally significant uranium operation and provides Deep Yellow with a strong platform to proceed with project financing, detailed engineering work, and maintain the timeline for FID, which is expected to be made in Q4 2024.

Link to 2023 Tumas DFS

Link to 2023 Tumas DFS Re-Costing Study

Award of Mining Licence

Shortly following the release of the Tumas DFS Re-Costing Study, the Namibian Ministry of Mines and Energy issued the mining licence for the Tumas Project. The licence is valid for 20 years from date of issue (September 2023) and allows Deep Yellow to progress the Project towards production, establishing Tumas as the 4th uranium mine in Namibia.

* Oponona (local Namibian partner) has a right to 5% of the project.