(OTC:DYLLF)

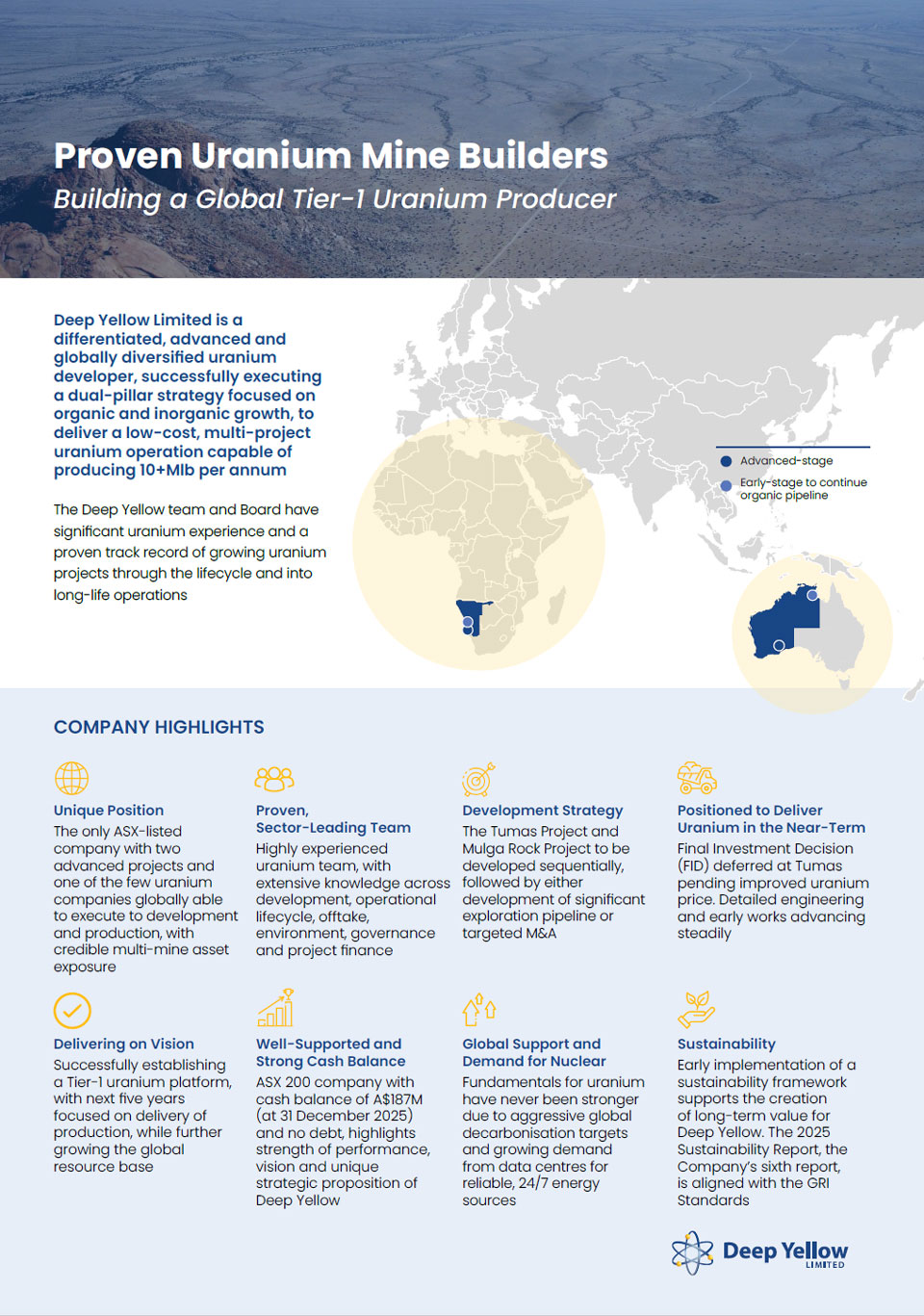

Building a Global Tier-1 Uranium Producer

Deep Yellow is the best positioned uranium mid-cap company globally

Led by a best-in-class uranium team, with a proven track record of successfully developing projects, Deep Yellow is methodically executing its dual-pillar strategy to establish a multi-mine company with capacity to produce 10+Mlb per annum.

The Company has acquired and developed a portfolio of geographically diverse exploration, early-stage and advanced uranium projects, which provide a strong development pipeline and significant growth optionality through expansion of its current uranium resource base by adding uranium “pounds in the ground”.

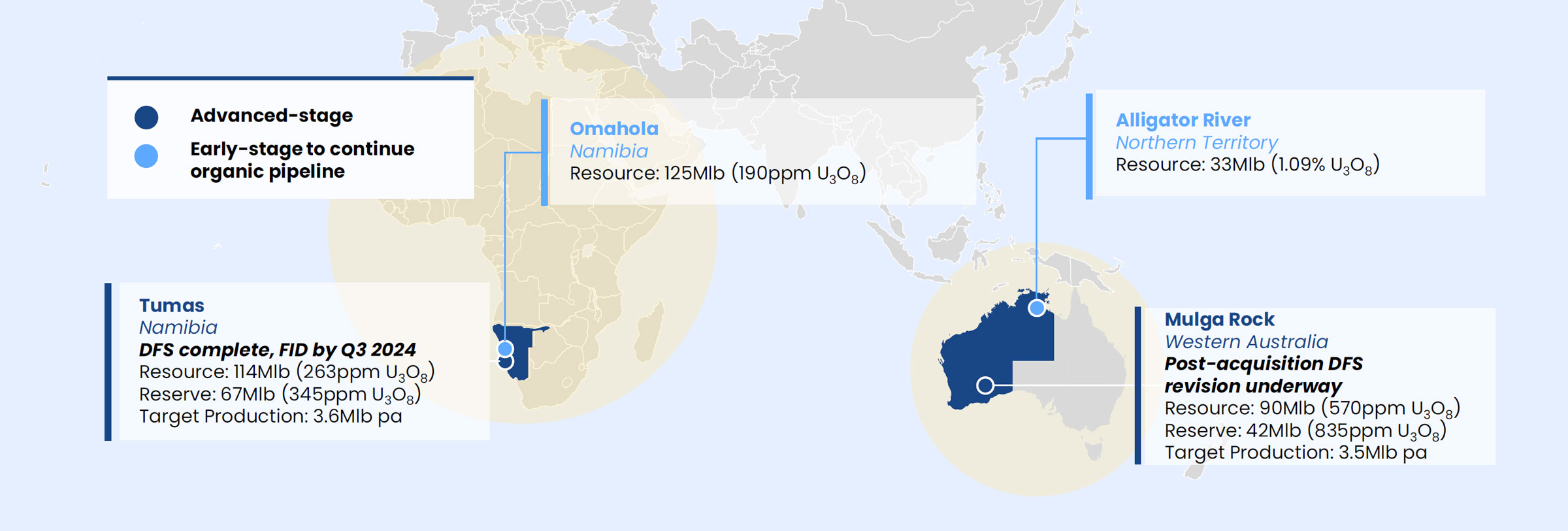

Deep Yellow is the only ASX company with two advanced projects, both located in Tier-1 uranium jurisdictions. The Company has worked very hard and with purpose to establish these exciting greenfields projects – Tumas in Namibia and Mulga Rock in Western Australia. Both projects combined have a potential production capacity of more than 7 Mlb pa, with Tumas expected to produce 3.6 Mlb pa with a potential 30+ year Life of Mine (LOM) and Mulga Rock at 3.5 Mlb pa and a 15+ year LOM.

In late 2023, Deep Yellow completed a review of the 2023 Tumas Definitive Feasibility Study (DFS), which generated excellent results and strengthened the Project’s status as a long-life, world-class uranium operation. Shortly after this, Deep Yellow received the mining licence for Tumas. A Final Investment Decision (FID) was initially targeted for March 2025, however this decision has been deferred as announced in April 2025. A staged development approach has been adopted, with engineering and early works continuing. Construction of the processing plant has been delayed until improved uranium price incentive supports greenfield project development.

A revised DFS at Mulga Rock is underway, with a key focus on completing an evaluation program to include critical minerals, rare earth elements and additional uranium, to increase the scale and LOM of the project.

The Company is well-positioned for continued organic growth through development of its highly prospective exploration portfolio which comprises Omahola (Namibia) and Alligator River (Northern Territory) and inorganic growth through further consolidation of targeted high-quality uranium assets.

The shift in global thinking and sentiment towards the adoption of nuclear energy continues to generate strong momentum for the uranium sector. Most major economies are in full alignment demanding more nuclear energy, as it is the only 24/7 clean energy source that can provide baseload power supply and numerous other vital applications, while achieving zero emissions. The need for more nuclear was highlighted at COP28, where over 20 countries signed on to the goal of tripling nuclear energy capacity to achieve net-zero emissions by 2050.

This has created an exciting opportunity for the uranium market, expected to result in exceptional growth and value generating opportunities for Deep Yellow, as the Company is well-placed to provide production optionality, security of supply and geographic diversity to a growing market.

Note: Resource & Reserve metrics reported on a 100% basis.

- Deep Yellow currently owns 100% of the Tumas Project. Oponona Investments (Pty) Ltd (local Namibian partner) has a right to acquire 5% of the Tumas Project post FID.

- Refer ASX release 18 December 2024.

- DFS forecast production capacity.

- 1.09% is equivalent to 10,900 ppm U₃O₈.

Please click below to view our latest Sustainability Report